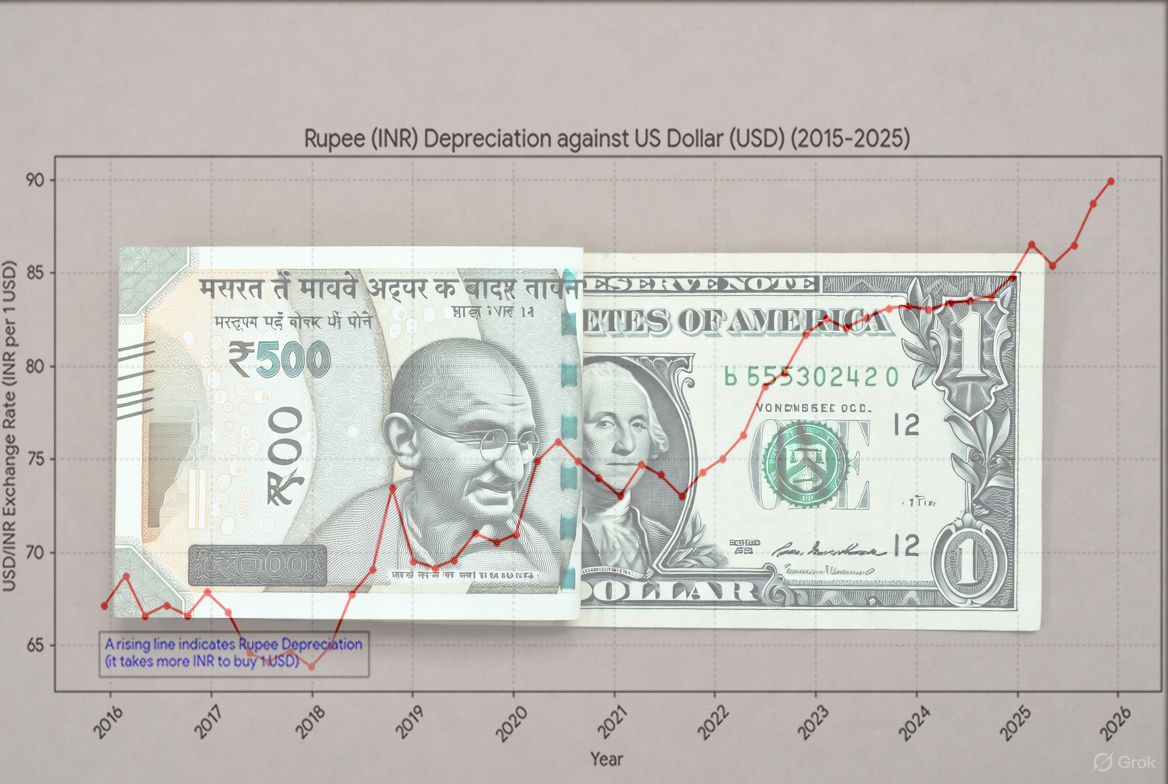

Rupee vs Dollar: Record Fall, Impact and Economic Illusions

You may still hear that the rupee will defeat the dollar, that India is already a global leader, and that everything is under control, but the numbers, the markets, and your shrinking wallet tell a very different story.

By the end of 2025, the Indian Rupee slid past the historic mark of ₹90 against the US Dollar, setting a new all-time low.

While many are now speculating whether it will breach the ₹100 mark, what truly matters is not the so-called “psychological barrier” but the deep economic reality this fall represents. A falling rupee signals structural stress in the economy, stress that cannot be hidden behind television debates or celebratory political narratives.

A weaker rupee makes imports costlier, and India is heavily import-dependent. Fuel, cooking oil, medicines, electronic goods, auto components, and fertilizers all become more expensive as the rupee weakens. Fuel price inflation alone pushes up transportation costs, food prices, manufacturing expenses, and the price of daily consumer goods. Experts have already warned that petrol, LPG, electronics, and medical equipment prices will rise sharply. This inflationary chain reaction will hit every household budget not in theory, but in real life.

Wider Economic Impact: Beyond Fuel and Daily Goods

The falling rupee will not spare key social sectors either. In healthcare, India imports a significant portion of its active pharmaceutical ingredients and medical equipment.

A weaker rupee directly means costlier imported medicines and higher hospital treatment charges. In education, students studying abroad will face higher tuition fees, increased living expenses, and costlier education loans. Parents will bear the double burden of inflation and depreciation.

Tourism and foreign travel will also suffer as air tickets, hotel tariffs, and forex conversions become expensive. A typical family travel budget could rise by 15 to 20 percent.

Now, looking at the government’s narrative vs economic reality, while the economic pain is clearly visible, a section of the Indian media and the ruling party’s loyalist ecosystem continues to celebrate the rupee’s fall as a “good thing,” claiming it boosts remittances, exports, and global competitiveness.

Ironically, the very leadership that once attacked Dr. Manmohan Singh relentlessly for a falling rupee now portrays depreciation as a masterstroke. The contradiction is stark. In 2014, Narendra Modi, as Gujarat’s Chief Minister, called a falling rupee a sign of economic failure. In 2025, the same phenomenon is being glorified.

When Everything Becomes ‘Good News’

Today, citizens are made to feel “normal” about ₹100 petrol, 500 AQI pollution, and shrinking savings. In such an environment, rupee depreciation is trivialized like a non-issue. But behind this normalization lies the exposure of three major economic lies, have a look:

Lie No. 1: “India is Fastest-Growing Economy at 8.2%”

The government recently showcased 8.2 percent GDP growth for the second quarter of FY 2025–26. But just before this announcement, the IMF downgraded India to a C-grade, citing methodological weakening and suspicious inflation trends. In October 2025, retail inflation plunged to an abnormally low 0.25 percent, which is not considered healthy for a growing economy. The RBI itself maintains that inflation should remain around 4 percent with a tolerance band of plus or minus 2 percent.

Low inflation artificially inflates GDP. Real GDP adjusts for inflation, while nominal GDP does not. With extremely low inflation, real GDP becomes mechanically inflated while nominal GDP grows only marginally. In Q2, real GDP growth stood at 8.2 percent while nominal GDP growth was only 8.7 percent. This narrow gap is a serious warning signal. As inflation rises again, this artificial GDP boost will vanish.

The current growth is being driven mainly by banking, technology, and other high-skill service sectors. Meanwhile, agriculture and rural wages remain stuck at around 3.5 percent. Over 50 percent of India’s workforce contributes just 16 percent of the GDP. This is not inclusive growth—it is elite growth.

Lie No. 2: “A Weaker Rupee Boosts Exports”

This is one of the most repeated economic myths. Over the last decade, the rupee has depreciated by over 35 percent, while exports have risen by barely 2 percent. Recently, exports have actually fallen by 12 percent. Even core sectors like textiles and automobile components have shrunk.

Meanwhile, the trade deficit has hit record highs, with gold imports alone pushing deficits to dangerous levels. If rupee depreciation truly helped exports, India would have witnessed a manufacturing boom by now. Instead, the Index of Industrial Production crashed to 0.4 percent by October, against the expected 3 to 4 percent. Manufacturing is not just slowing—it is struggling.

Lie No. 3: “Rupee is Falling Only Against Dollar”

This claim has now completely collapsed. Today, the Indian Rupee is the worst-performing currency in Asia and is weakening not only against the dollar but also against the euro, the pound, and most Asian currencies.

The Finance Minister earlier claimed the rupee was “stable” and only the dollar was strengthening—much like the argument that ethanol is “better than petrol.” Both arguments have aged poorly.

Foreign Investors are Leaving India

In 2025 alone, nearly $18 billion worth of foreign investments exited India. The US imposed reciprocal tariffs of nearly 50 percent, and ever since Trump revived the protectionist trade regime, the Indian Rupee fell another 5.5 percent. High taxation combined with a weak rupee has broken investor confidence.

China used Bangladesh’s political instability as an opportunity to capture textile manufacturing. India missed the chance completely. Countries like Bangladesh built 24×7 export manufacturing hubs and attracted global brands like Zara and H&M, while India mostly exported raw cotton.

If Depreciation is So Good, Why Was ‘Make in India’ Needed?

If currency devaluation alone could create exports, jobs, and manufacturing growth, then why did the government launch programmes like Make in India, Atmanirbhar Bharat, and PLI schemes?

Why did the RBI spend $34.5 billion in dollar sales in just one year to stabilize the rupee? This contradiction exposes the hollow nature of the government’s narrative.

India imported over $915 billion worth of goods in 2024–25, and imports have only increased in 2025. Major imported items include petroleum, medicinal raw materials, cooking oil, auto parts, and electronic components.

As the rupee falls, import bills rise, retail prices surge, and household savings collapse. While NRIs may gain through higher remittances, the middle class, students, small businesses, daily wage earners, and the common taxpayer bear the real burden.

The government has dismissed every uncomfortable global index—from corruption and press freedom to democracy and happiness. But the rupee cannot be dismissed as a conspiracy. It reflects market confidence, trade balance, foreign investment, and economic credibility. No amount of PR, WhatsApp forwards, or prime-time debates can rewrite this economic truth.

Conclusion: The Illusion is Breaking

The fall of the Indian Rupee has raised costs, shrunk savings, driven away investors, exposed policy contradictions, and uncovered the illusion of “fastest-growing economy” claims.

You may still hear that the rupee will defeat the dollar, that India is already a global leader, and that everything is under control. But the numbers, the markets, and your shrinking wallet tell a very different story.

[Mohd Ziyauallah Khan is Freelance Content Writer and Editor based in Nagpur. He is also an Activist and Social Entrepreneur, Co-founder of TruthScape, a team of Digital Activists fighting disinformation on Social Media.]

Follow ummid.com WhatsApp Channel for all the latest updates.

Select Language to Translate in Urdu, Hindi, Marathi or Arabic